April 13-16, Atlanta, GA

Industry Expert Talks

Businesses adopt robots without an automation strategy

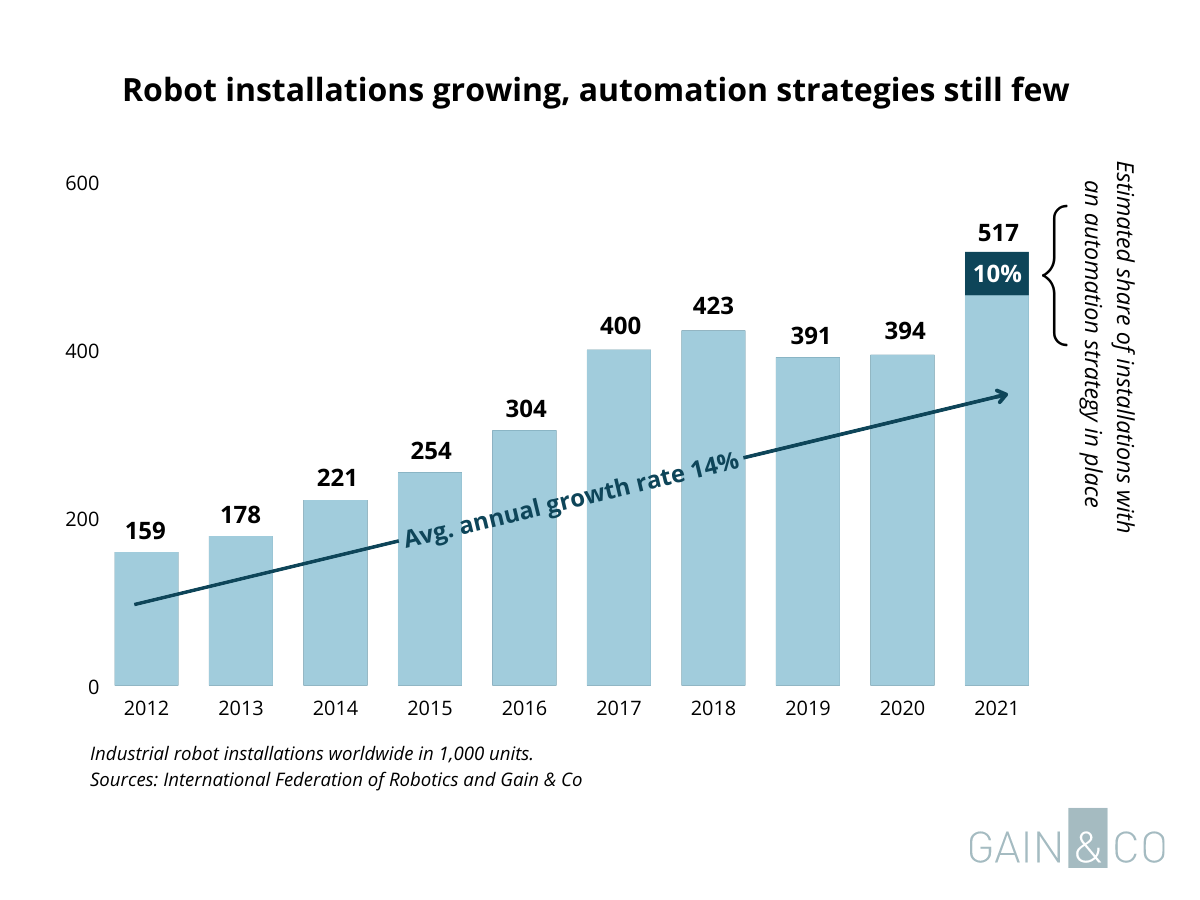

Robot adoption is at a historical high. Businesses from not just the automotive sector but a range of new industries are embracing the opportunities that robot and automation technologies have to offer. This is largely driven by a series of macro forces, including labor shortages, that are shaking up manufacturing supply chains globally, speeding up the inevitable trend of automating manual labor.

The sudden increase in robot adoption has happened over a short span of years, leaving businesses little time to adapt. Few businesses yet fully understand how to leverage robot technology and maximize its value over the long term. The lack of automation strategies in these businesses is a clear sign of that. Our analysts estimate that roughly 9 out of 10 robot investments are made without a documented automation strategy in place.

Only 10% of installations are made with an automation strategy in place.

A complete strategy guides businesses on both the why and how of automation. Many businesses have a declared interest in automation but, aside for a small minority, they have not yet translated these intentions into executable plans.

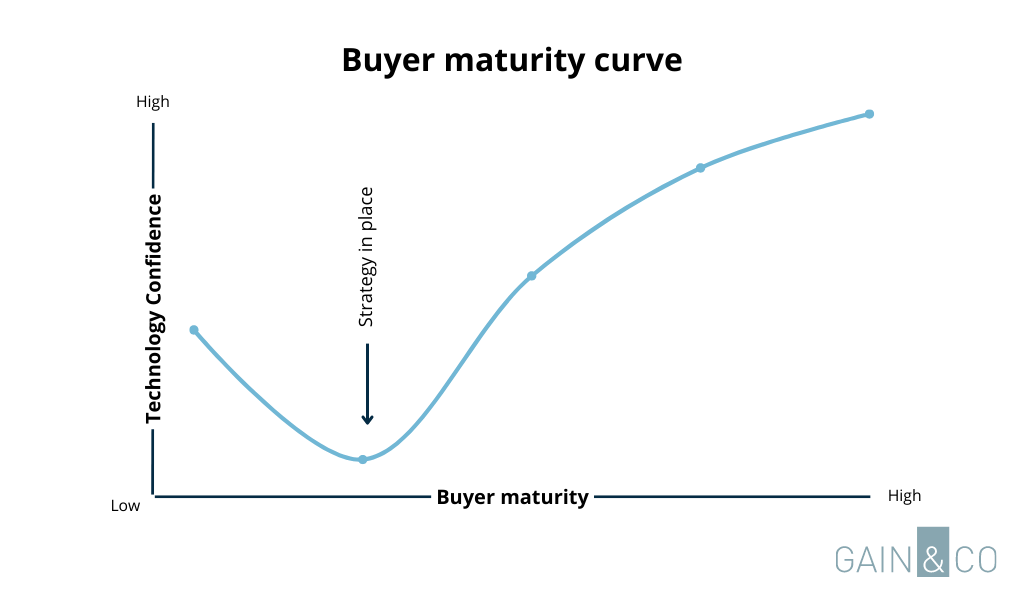

This is a common pattern for new technology adoption. The first time businesses implement a new technology, it is often sporadic and unplanned. Then, as end-users and suppliers mature, focus shifts to the purpose of the technology, getting aligned with business goals and increasing efficiency – in other words, the things a strategy helps accomplish.

When this transition happens over a very short period of time, as in this case, businesses struggle with adapting their organization to the changes – which often slows down adoption beyond the first investments.

Signs that strategies are lacking

Automation strategies generally provide companies with a clear plan on what to automate that is aligned with the goals of the business. The strategy also helps set meaningful automation performance targets and defines success. Consequently, without a strategy, businesses are unable to properly evaluate the outcome of automation projects and understand if they delivered on their promise. This knowledge is required to scale automation successfully beyond the first few pilot projects.

The way deals are structured in the automation market today show clear signs of missing strategies.

Some prevalent signs include:

1. Lacking prioritization of automation efforts

Without a strategy, automation is often implemented sporadically without a company-wide understanding of which efforts should be prioritized and why. This makes it difficult for management to know which investments provide the most value for money and are most likely to succeed. Scaling automation investments without a strategy further increases the risk of failure. Some companies are beginning to have a structured process for mapping out automation opportunities on a facility or company-level, though it is still the exception rather than the rule. Such a process often includes evaluating and scoring the benefits and risks of each automation opportunity and weighing them against the company goals.

2. No evaluation of technology maturity

Robot technology is evolving fast. Robots and automation can be used for almost anything today, with some estimating that about 60% of tasks in the manufacturing sector can be automated. At this speed, there is a high likelihood that businesses have outdated knowledge about the capabilities of current technologies. Few businesses have processes in place to update their knowledge and evaluate the technology maturity before investing in automation. This increases the risk of either underestimating what the technology is capable of, thereby missing out on valuable investments; or overestimating its capability, hence investing in immature technology that is unreliable and does not meet the desired targets for throughput, etc.

3. Missing automation goals

It is still relatively uncommon to see automation projects accompanied by clear, documented goals aligned with the overall business strategy. Without these goals, businesses often lack a shared understanding of the purpose of automation. A side effect of this is delayed automation projects caused by misalignment between business units on the overall scope of automation. The misalignment often shows in project specifications where these goals are not explicitly communicated to automation vendors along with the associated performance targets of the equipment to be purchased. As a consequence, there are no objective criteria to evaluate what solutions best meet the needs of the business and upon which to base investment decisions. Ultimately, without clear targets, there is no way of knowing if the automation investment was successful or not.

4. Seller-centric solution proposals

The automation market is for the most part dominated by seller-centric solution proposals, that mostly specify what the automation solution is and not what it does for the customer. With the absence of clear goals and targets from the customer, the conversation with suppliers often becomes centered around the technical specifications of the solution in the language of the seller. This shifts the burden of proving the value of each solution away from the seller and onto the customer instead. Many businesses, especially those that are new to automation, do not have the required level of technical expertise to adequately assess and compare how each solution stacks up to their needs. This increases the risk of getting a negative return on investment due to suboptimal performance of the solution. Making business goals and performance targets the centerpiece of the requirements turns the conversation around and forces suppliers to address them in their proposals.

5. Unknown business value of automation

The rapid increase in robotics and automation has left businesses with little time to evaluate the outcome of their investments and adjust accordingly. This knowledge is critical to scale automation successfully – i.e., profitably – within a company. Without it, businesses struggle with moving past the initial pilot projects and making automation a widespread success, simply because the financial risk becomes too great. One of the key reasons is the absence of objective metrics tied to company goals that allows the business to evaluate the outcome of their automation investments.

The abovementioned signals are commonly seen in a growing market of emerging technologies. It is expected that the initial euphoria over a new technology will – over time – be replaced by a more systematic approach guided by a strategy.

--

Søren Pap-Tolstrup is the CEO of Gain & Co, independent advisors on robotics and automation. Gain & Co support large enterprises, including Fortune 500 companies, SMEs, and public institutions worldwide throughout each phase of the automation process to ensure business goals are met and solutions are implemented effectively. The company is 100% market neutral with no ties to suppliers.