April 13-16, Atlanta, GA

Robotics & Market Insights

The growing Dutch robotics industry faces “market adoption gap”

The Netherlands is home to a large number of robotics companies, developing new technologies aimed at making a wide range of industries more productive. There are farming and milking robots for the agricultural industry, mobile robots for warehouses, drones for surveillance and countless other applications covered by the industry’s 350 robot and automation suppliers analyzed in the recently published market report from HowToRobot in collaboration with High Tech NL Robotics, the Dutch cluster of robotics companies.

What many of these companies have in common is that they have developed promising technologies that they have yet to commercialize, says Thijs Dorssers, manager at High Tech NL Robotics.

“There are a lot of robotics companies with very good ideas and products, but they are lacking the commercial side of the business,” he says and points out that the industry is facing a “funding gap” as a result.

Robotics startups, he says, often spin out of universities, where they have ample access to funding for researching and developing the first products, often provided in the form of grants. But when it comes to further commercializing the products and scaling the business, funding is scarce – as can be seen by the level of venture capital investments in the industry. Over the past five years, a total of 32.4M USD was invested in robotics companies in the Netherlands according to data from Dealroom.co. This places the Netherlands in the 15th place among countries in the European Economic Area (EEA, including the UK and Switzerland) by total amount invested (excluding grants).

“The lack of funding for robotics startup growth is an issue. The investors are there, but they are not willing to invest before the companies become more market driven and change focus to its potential customers,” Thijs Dorssers says.

Robotics companies in the Netherlands received a total of 32.4M USD in venture capital investments (excluding grants) during the period of 2018-22 according to data from Dealroom.co, placing the country 15th in the EEA by total amount invested.

Association: “Commercial co-founders needed”

One of the primary obstacles for robotics companies to grow further, according to Thijs Dorssers, is a lack of commercial people on the team.

“Many companies have CEOs with technical backgrounds, and are missing co-founders with a commercial background,” he says.

This influences how some companies prioritize their funding, often allocating most of it to developing new products and comparably less on marketing and sales.

“Marketing and sales are relatively underfunded in the growth stages of the startups. The awareness of the industry must change to include other aspects of the business such as sales and marketing, finance, and human capital,” Thijs Dorssers says and encourages robotics companies to seek out and talk to potential clients “in the hundreds” to get a better understanding of product-market fit.

See what automation buyers are looking for on HowToRobot’s marketplace

Labor shortages increase the need for automation

There is a very good reason for robotics companies to build out their commercial capabilities according to Thijs Dorssers: The need for automation is growing fast, both in the Netherlands and abroad.

The Netherlands is already a fairly automated country, ranking 13th globally by robot density with 224 robots per 10,000 workers in the manufacturing industry according to the International Federation of Robotics (IFR). And there is plenty of room for further growth, Thijs Dorssers points out:

“There is a lot of potential for the manufacturing industry and other industries such as agriculture to increase robot adoption. Most sectors have a shortage of people and must invest in automation to make up for it,” he says.

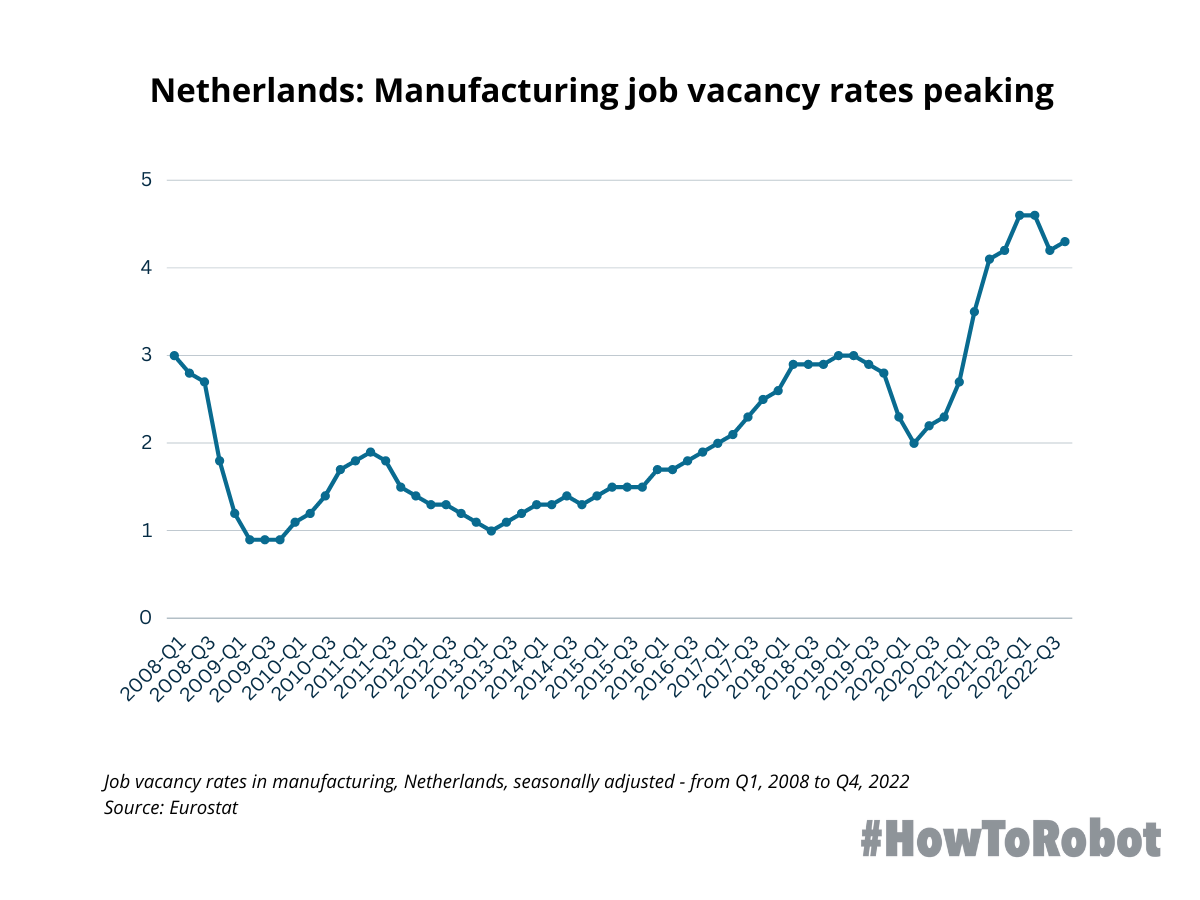

In the manufacturing industry, it has gotten increasingly difficult to find employees over the past couple of years. Since 2020, the job vacancy rates in the Dutch industry have reached record-high levels, peaking at 4.6% during the first two quarters of 2022.

Other industries such as agriculture are also struggling with shortages of seasonal workers and are becoming increasingly interested in automation as a result according to Thijs Dorssers.

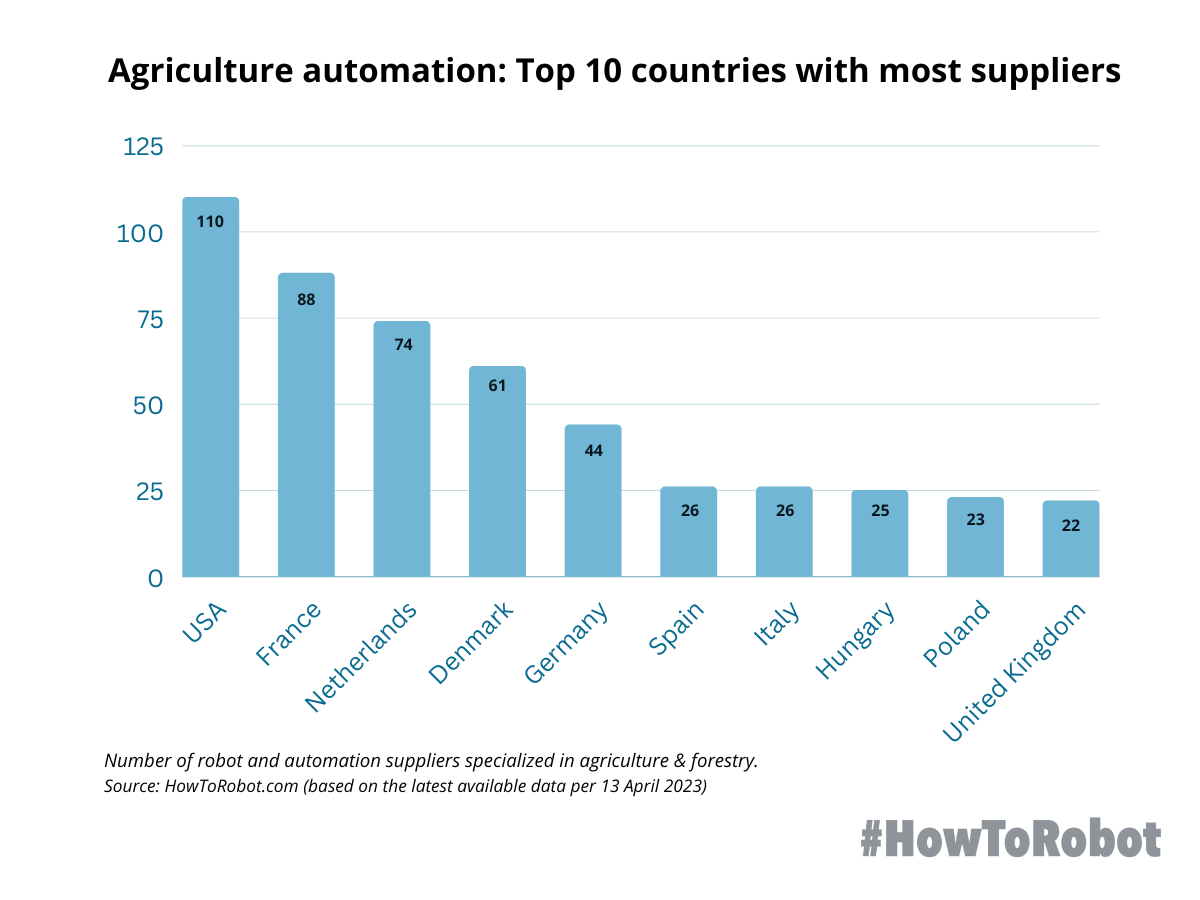

The agricultural industry, although still a niche market, presents a growing opportunity for the Dutch robotics industry, he says. The global market for autonomous agriculture robots is estimated to grow at a compound annual growth rate (CAGR) of 19% during 2022-27. The Netherlands has a particular strong focus on agriculture automation, ranking 3rd globally by number of robot and automation suppliers to the industry according to data from HowToRobot.

“The Netherlands is a country of agriculture, which also shows in our robotics industry that is developing many new solutions for farmers. With the labor shortages within agriculture in Europe and the U.S., automation is needed,” he says.

Association: Robotics growth requires new business models

In order to tap into the growing demand for automation, robotics companies must find ways to adapt existing business model and build new ones catered to end-users with different needs than traditional automation customers, says Thijs Dorssers.

Within agriculture, for example, the shortage of labor is typically temporary and happens during peak season. This also limits the need for certain types of automation solutions to those periods and makes farmers hesitant to make large capital investments in equipment that go unused for most of the year.

“These types of robotic end-users would be more interested in leasing the solution during peak season. Adapting to this type of business model could increase robot adoption, but it is still very difficult to find robotics companies that are offering it,” says Thijs Dorssers suggesting that the robotics industry has a lot to gain by understanding end-users better and helping them understand in their own terms the value that automation provides.

“Even though many companies have a high potential for automation they are not always aware of it, especially smaller companies. But if you can explain what can be achieved by automating and what the return on investment will be, they are more likely to invest,” he concludes.

--

For more insights on the Dutch robot and automation market, read the 2023 Robot Market Report.